Both of these books have been added to the idleguy.com library in pdf formats. Click on the titles to download your own copy. Feel free to share. Knowledge is power. You're welcome.

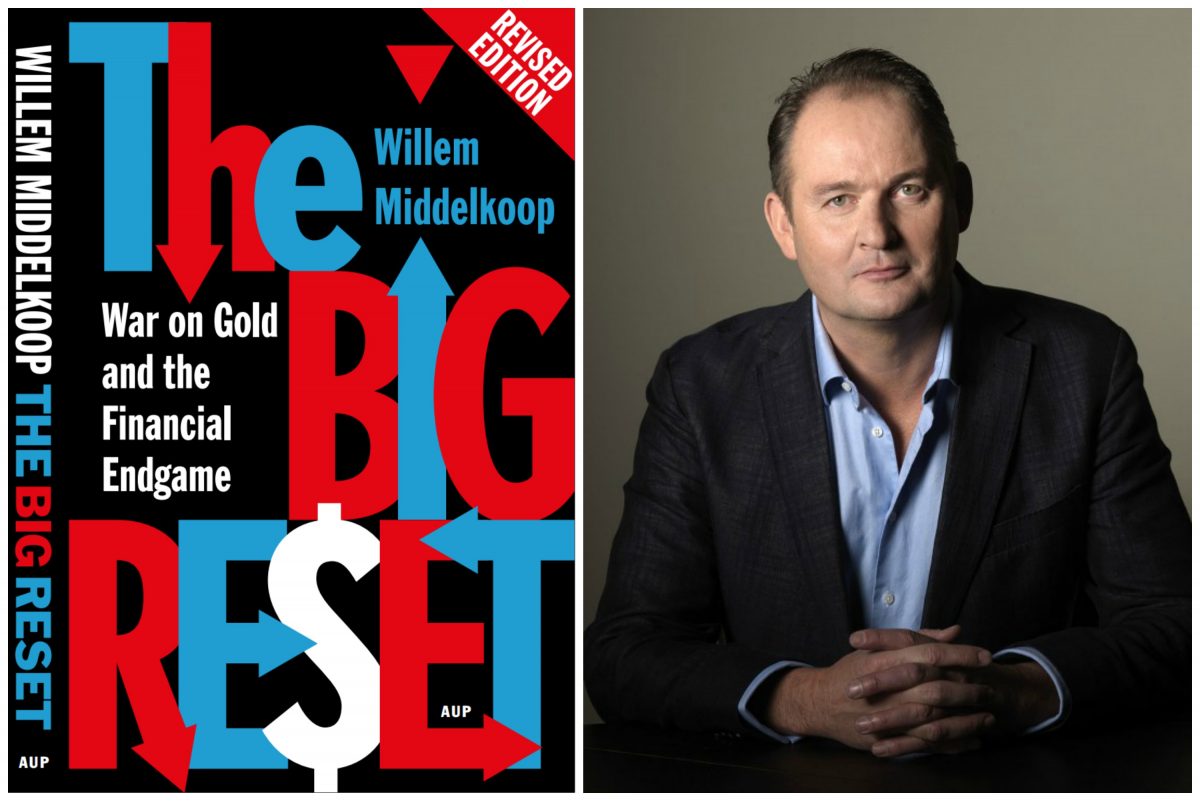

The Big Reset - by Willem Middelkoop

With a knack for simplifying complexity, Middelkoop provides historical references to the evolution of money and how economies have grown... and faltered, from antiquity to the modern day.

Originally published in 2014, "The Big Reset" makes the case for a return to a gold standard when fiat currencies meet their ultimate demise.

The book is a quick read, but it is packed with valuable background information on how modern economics has distorted the nature and meaning of money and espouses a path to a better future.

Briefly:

Chapter 1 - The History of Money

Chapter 2 - Central Bankers: The Alchemists of our Time

Chapter 3 - The History of the Dollar

Chapter 4 - A Planet of Debt

Chapter 5 - The War on Gold

Chapter 6 - The Big Reset

Middelkoop's insistance that gold is money isn't a novel idea by any means. Famously, J.P. Morgan expressed his view thusly, "Gold and silver are money. Everything else is credit."

When Money Dies - by Adam Fergusson

When Money Dies - by Adam Fergusson

In the aftermath of World War One, Germany was punished severely by the countires it opposed and was eventually defeated by. Reparations were so severe that the country, organized as the Weimar Republic, suffered the worst hyper-inflation the world had ever seen. Germany's currency was reduced to dust. Fergusson crafts his tale from actual experiences of people recalling the horrors of the time in stunning detail.

From Chapter 1: Gold for Iron

JUST BEFORE THE First World War in 1913, the German mark, the British shilling, the French franc, and the Italian lira were all worth about the same, and four or five of any were worth about a dollar. At the end of 1923, it would have been possible to exchange a shilling, a franc or a lira for up to 1,000,000,000,000 marks, although in practice by then no one was willing to take marks in return for anything. The mark was dead, one million-millionth of its former self. It had taken almost ten years to die.

Both of these books have been added to the idleguy.com library in pdf formats. Click on the titles to download your own copy. Feel free to share. Knowledge is power. You're welcome.

Both of these books have been added to the idleguy.com library in pdf formats. Click on the titles to download your own copy. Feel free to share. Knowledge is power. You're welcome.

When Money Dies - by Adam Fergusson

When Money Dies - by Adam Fergusson