Nobody has a crystal ball, even the bright guys on Wall Street. When it comes to predictions, everybody wants to pick a winner and very few analysts ever issue discouraging remarks about the upcoming year.

Thus, if the year turns out to be a loser, the vast majority of analyst predictions are tossed to the wind.

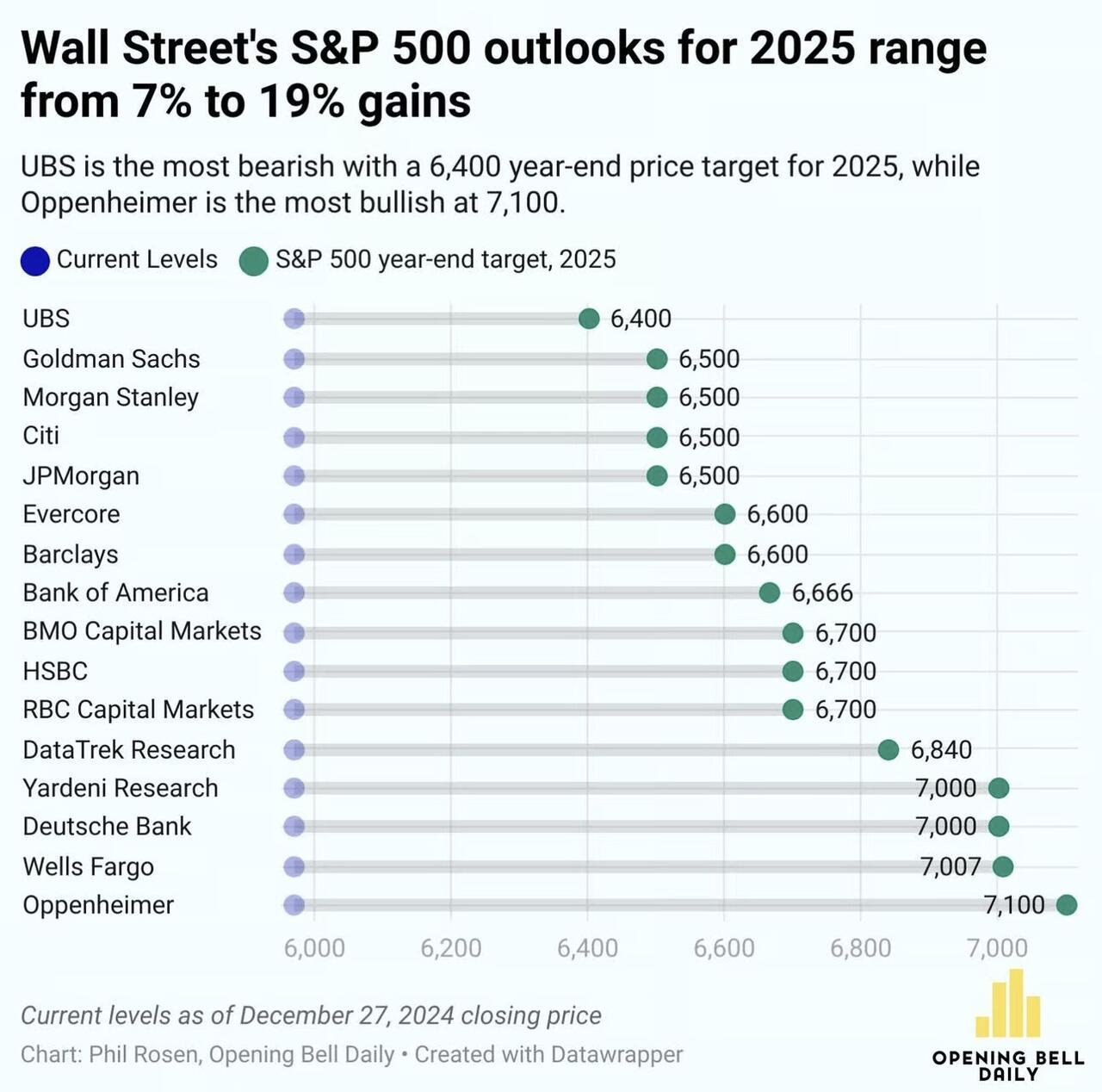

Thanks to Phil Rosen at Opening Bell Daily for the following swell graphic.

As clearly displayed by the graphic, none of the big investment houses are predicting anything less than a 7% gain on the S&P 500 in 2025. This is after the first back-to-back gains of over 20% since 1997-1998.

That's not to say that 2025 is going to be a down year, but there are warnings signs on the horizon, not to mention stock performance in December. The Dow, S&P, and NASDAQ were all down for the month. The Dow led the retreat, losing five percent. Next was the S&P, down 2.75%, and the NASDAQ, which finished December just about flat.

About a month ago, I started looking around for anybody who thought like I did, that incoming President Trump's economic plans might just be a little on the deflationary side.

At first, I was a lone voice in the desert, but, towards the middle of the month, a few more somewhat contrarian thinkers were starting to chime in with alarm bells of their own.

The video in the sidebar from Peak Prosperity's Chris Martenson, lays out quite an agenda, inferring that much of the economic data from the past year was pure bunk, designed to boost Biden's - then Harris' - chance at hitting it big in the presidential lottery, ushering in another four years of unbearable policies, waste, abuse, and corruption.

We all know what happened. Reality stuck its camel nose under the political tent and Donald Trump won handily.

Thus, the economic data from late 2023 through fall of 2024, particularly employment, inflation, and GDP, cannot be trusted and are likely to be revised lower, just as the Non-Farm Payroll monthly data has been summarily revised and rejected by some 1.2 million jobs over the past year.

Edward Dowd, a founding partner at Phinance Technologies, was recently interviewed by Greg Hunter on his USA Watchdog channel as seen below. (Editor's Note: Greg Hunter is now recording exclusively on Rumble, probably because he's not well aligned with the Google algorithms and narrative.)

Dowd, a serious number-cruncher, says the Biden economy was propped up by sugar juice, including extensive, excessive government hiring, open borders and free money for illegal migrants.

Dowd sees a recession coming in the first half of the year as Trump's policies and the DOGE team goes to work taking an axe to waste in Washington, of which there's no shortage.

Add Martin Armstrong to the chorus who sees trouble brewing in the first half of 2024, and now we're singing as a quartet.

Update: January 7, 2024

Some of the issues which are likely to become headwinds to the stock market in 2025 could be self-inflicted. Main among them are Trump's proposed tariffs and the effect that Elon Musk and Vivek Ramaswamy have on the government's profligate spending via their DOGE mandate.

Proposed tariffs include possible 20-40% tariffs on goods and services from neighboring countries, Mexico and Canada. Trump has indicated that he will "take no prisoners" in reviving America's manufacturing base, and that could spell trouble for neighboring states which choose to act as proxies for China, exporting to the U.S. after importing from the People's Republic.

Any hint that Canadian firms are attempting to circumvent Trump's policies will likely result in increased tension and supply chain disruptions. Since the latter are baked into the tariff agenda, it's probable that U.S. manufacturers or assemblers of foreign-made parts may suffer delays in production similar to those experienced under the COVID regime in 2020 and 2021.

DOGE, the unofficial Department of Government Efficiency, is designed to cut excess from the U.S. spending budget. The gargantuan federal bureaucracy will be under the microscope of the fledgling agency, which, via the presidential prerogative of executive orders could simply announce mass layoffs or shutter entire departments.

What many in official Washington does not expect is for DOGE to go after the MIC and the waste and abuse that emanates from the Pentagon in procurement of materiel that is overpriced, obsolete, or otherwise unnecessary to the defense of the nation. Elon and Vivek could very well go after the Defense Department with gusto. There's also the distinct possibility that Trump will decommission an entire assemblage of "woke" generals, admirals, and other high-ranking officers in the military command. He's not fooling around this time. The military will follow his orders or face expulsion, court-martial or worse.

Beyond the tariff agenda and DOGE handiwork, there's also the element of backlash coming from multiple sides, including the congress and the federal labor unions, to say nothing of BRICS-aligned countries countering with trade barriers of their own in response to tariffs and sanctions.

Considering sanctions, Trump would be wise to discontinue the practice of punishing countries that are uncooperative or otherwise deemed security threats. As has been clearly evidenced by the sanctions on Russia, they are largely ineffective and have their own nasty after-effects, further alienating the United States in international trade.

How these newly-implemented polices pan out will have some effect on U.S. business interests. At the very least, companies doing business outside the U.S. will face angry suppliers and customers in the short term and may lose business in the longer term. That's not a scenario that Wall Street would welcome. Further, if DOGE takes on a forward posture, there could be layoffs and displacements of government workers on a grand scale, sending unemployment claims soaring and putting pressure on the private sector to absorb the freed-up former bureaucrats, many of whom have few skills beyond sharpening pencils and pushing paperwork around to the next flunky.

Much of this adds up to a general malaise and a government that, in the first year of Trump's administration, will be largely ineffective and downsizing. The chaos caused by tariffs, sanctions, layoffs, cost-cutting, and generalized austerity at the federal level might also have a trickle-down effect to state and local governments, also burdened with excess spending, bureaucracy and public employee unions.

If Trump is successful at reordering America's priorities, there's almost a 100% certainty that there will be ample pain spread throughout the public and private sectors.

In the end, after the economy has readjusted to the newer realities, there will be bargains galore, though one would be wise to choose carefully and be patient. Warren Buffett is not sitting on about $350 billion in cash for his health. He's looking to grab up bargains through acquisitions after stocks adjust to lower, more realistic levels.

For those reasons and a bevy other other potential market-busting scenarios, idleguy.com isn't going to make any predictions on where markets are headed in 2025, other than to suggest caution for possible downward momentum.

-FR

These are just a few of the myriad of disruptive policies and possibilities that investors need to weigh before committing to buying shares of specific companies. Besides the idea that stocks are wildly overvalued to begin with, disruptions like those mentioned above could very easily cause a market crash of monumental proportions.

|

|||

| search engine by freefind |

Your ad could be in the next issue of idleguy.com for as little as $6 per month. Contact Fearless Rick using the form on page 12 for more information.

As usual, Dr. Chris Martenson knocks it out of the park in his final Peak Prosperity public video of 2024, The Chickens are Coming Home to Roost.

This is another vital episode where I continue to chase the elusive Big TOE (Theory of Everything). This time, it's noting that the War On Reality by those currently in power, is a failing strategy that promises to end badly. Will that moment arrive in 2025? I think so.

IdleGuy.com tracks:

From Money Daily:

1/5/25: WEEKEND WRAP: 2024 Solid Performance In the Books; 2025 Gets off to Rocky Start; Gold, Silver Rebounding; Oil Price Overheating