Like it or not, we're in the middle of a global economic war.

by Fearless Rick, July 1, 2025

Editor's Note: This article is a work-in-progress, derived from personal investigation, research, knowledge and insights from two recent articles, Vince Lanci's Complete BRICS 2025 Summit Analysis and Dan Fournier's ground-breaking article on his Inconvenient Truths Substack, One Great Financial Reset, Two New Monetary Systems. Both are recommended reading, FOR YOUR OWN WELL-BEING.

As such, and with much of the news flowing rather quickly at present, there will be updates throughout the month. - FR

UPDATE, JULY 7, 2025:

The 17th BRICS Summit formally closed on Monday, July 7, issuing a joint declaration, as is the organization's practice.

The declaration [story with full text available for download HERE] highlights how BRICS leaders jointly adopted 126 commitments covering global governance, finance, health, artificial intelligence, climate change, and other strategic areas.

The declaration itself, titled, "Strengthening Global South Cooperation for More Inclusive and Sustainable Governance", emphasized BRICS commitment to multilateralism and a more equitable global order.

Here are some of the key sections and take-aways from the declaration:

In section 6, the group calls for a more equitable UN Security Council, aiming for the inclusion of Brazil and India as members of the Security Council.

Sections 10, 11, and 12 takes aim at reforming Bretton Woods Institutions (BWI), particularly the World Bank and International Monetary Fund, with more attention paid to Emerging Market and Developing Countries (EMDC).

Section 13 admonishes the World Trade Organization (WTO) for its tacit approval of U.S. President Trump's tariffs. Section 14 targets U.S. sanctions policy.

22. We recall our national positions concerning the conflict in Ukraine as expressed in the appropriate fora, including the UN Security Council and the UN General Assembly.

24. We reiterate our grave concern about the situation in the Occupied Palestinian Territory, with the resumption of continuous Israeli attacks against Gaza and obstruction of the entry of humanitarian aid into the territory.

25. We recall that the Gaza Strip is an inseparable part of the Occupied Palestinian Territory. We underline, in this regard, the importance of unifying the West Bank and the Gaza Strip under the Palestinian Authority, and reaffirm the right of the Palestinian people to self-determination, including the right to their independent State of Palestine.

Under the general heading, Deepening International Economic, Trade and Financial Cooperation, sections 42 though 80 cover everything on the economic front, including Multilateral Trading, Digital Economy, International Trade, Financial Cooperation and Trade, Sustainable Development, Infrastructure, AI, the New Development Bank and its New Investment Platform, and especially development of a BRICS Multilateral Guarantees (BMG) initiative, which aims to offer tailored guarantee instruments to de-risk strategic investment and improve creditworthiness in the BRICS and the Global South.

In sections 49 and 50, the RICS Interbank Cooperation Mechanism (ICM) and BRICS Cross-Border Payments Initiative are highlighted.

Much of the remainder of the document is boilerplate language addressing climate change, promoting sustainable, fair and inclusive development, and promotion of human, social and cultural development, much of it very much the same language as contained in the Kazan statement from 2024.

Vince Lanci's expectation of China announcing its gold initiative at the summit did not come to pass. Vince is usually off the mark on most of these issues, bloviating more than needed, and usually cribbing somebody else's work, which was likely the case with the China gold story. Idleguy.com regrets using VBL or his GoldFix platform as reference, and is unlikely to do so in the future.

However, speaking of bloviating, just as the BRICS summit was wrapping up, President Trump was out threatening various countries - and especially BRICS-aligned ones - with tariff extortion again.

In particular, the president posed on his social media platform, Truth Social, "Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff There will be no exceptions to this policy. Thank you for your attention to this matter."

Essentially, President Trump has further alienated about 60% of the global economy, menacing nations seeking to escape from decades of U.S. dollar hegemony, bypassing the US$ and the SWIFT system, by trading amongst themselves using native currencies. The BRICS are also not "anti-American" as the president purports.

It's hard to imagine a worse policy than threatening tariff sanctions against such a large group of similarly-minded countries. Additionally, the president posted letters to heads of state of various countries with a form letter, outlining plans to implement tariffs on imports to the U.S. of 25% on Japan, South Korea, Malaysia, Kazakhstan, Tunisia, South Africa (30%), Laos (40%), Myanmar (40%), Bosnia and Herzegovina (30%), Indonesia (32%), Bangladesh (35%), Serbia (35%), Cambodia (36%), Thailand (36%) to take effect on August 1.

Trump's grand scheme to raise government revenues via tariffs and/or increase America's industrial capacities by encouraging countries to avoid tariffs by building manufacturing facilities in the United States is a bold endeavor, though it may be too little, too late. The rest of the world (ROW) does not need Americans to buy their products. The United States dollar hegemony era has run its course. The country is on the hook for more than $37 trillion in government debt which is likely unplayable, unless it is inflated away.

By bullying pretty much the rest of the world to accept dollars in trade dealings and impose heavy tariffs on top of already-existing sanctions may be too much for most countries - and their enterprises - to bear, especially when the U.S. has weaponized the dollar, using it as a bludgeon to extract concessions on everything from trade to political alliances to military engagements from countries that intend to o the U.S. no harm.

Some of the ramifications to be expected as the Trump tariff trauma continues are, beyond passing the tariffs along to the consumer through higher prices, for countries to export substandard goods, limit trade with the U.S. altogether, purposely disrupt supply chains, or, in the case of countries like Japan and South Korea, export cars built in the U.S. back to their own countries, explicitly undermining the president's goals. What can we expect next, export duties?

American consumers will likely bear the brunt of these ambitious policies through higher prices, or, perhaps even worse, diminishing choices and empty shelves. The United States and president Trump need to understand that the 2020s are not the 1950s. The United States has squandered its "exceptional privilege" of having the world's reserve currency and a prosperous nation. Trump's policies, including haranguing Federal Reserve Chairman Jerome Powell to "lower rates" are likely to invite another bout of inflation or possibly a depression, should countries decline to entertain the president by accepting his trade policies.

Wall Street's response to the latest round of tariff trauma was a rather unhealthy - though timely - selloff on Monday, July 7. 2025.

Original article posted July 1:

Here's a bit of an overview from a Western perspective:

By incrementally monopolizing necessities (food, water, shelter, utilities, medicine, even information), by debt expansion, and by wage suppression, we now work in their company "mines" (cube farms, whatever), live in their company housing (mortgage/rent), shop in their company store (credit card debt), and pay MONOPOLY prices for basic necessities.

Literally, cradle to grave slavery to a small collection of "Nanny" Transnational Corporations (all owned at the top by a handful of investors).

It appears that everybody's headed to "Galt's Gulch", the legendary hideout for dissidents in Ayn Rand's epic, Atlas Shrugged, which is available for free download on this month's Books Page.

Once 65-85% of the population gets "herded" into 15-minute cities or magalopolies, like New York, LA, Mexico City, London, et. al., governments will launch CBDCs (Central Bank Digital Currency), by which they will control not just how much "money" you will receive, but how you will spend it. Programmable currency, at the click of an internet switch.

There's likley time to adjust prior to liftoff of the "beast" currencies, but time appears to be growing short. The U.S. is on the brink of complete economic collapse, despite what the stock market and guests on CNBC tell you. $37 trillion in debt, with countless millions receiving government subsidies (Social Security, SNAP, Medicare/Medicaid, Veteran's Benefits, etc.), the path to solvency seems unlikely, despite promises from politicians and big, beautiful continuing resolutions in congress.

Recent passage of the GENIUS act by the Senate - on its way to the House and then to President Trump's desk - assures promotion of stablecoins such as Tether, Circle, and others to follow, with two goals in mind:

1) To buy up Treasury issuance that the rest of the world might not want. By keeping Treasury debt auctions somewhat "in-house", the government and the Fed can keep interest rates from exploding higher as demand for bills, notes, and bonds flounders.

2) To get more people accustomed to digital currency. Bitcoin was surely a government deep fake that promised anonymity, peer-to-peer seamless transactions, and low fees. Over time, bitcoin and the thousands of crypto-imitators it spawned became the playground for Wall Street institutions and an asset class all to itself. Promises made became promises broken as exchanges, ETFs, and deep Wall Street involvement became embedded in the crypto experience.

The two biggest stablecoins are Tether ($USDT) and Circle ($USDC), both committed to 1:1 relationships with the US$ through treasury pruchases.

Meanwhile, in countries far away, like China and Russia, BRICS countries have been de-dollarizing since the US, UK, and EU jointly froze Russian assets valued at somewhere between $500 and $600 billion, increased economic sanctions, and kicked them off the SWIFT system of international trade messaging and transactions.

At some point, there's going to be a collision between CBDCs and BRICS that will shake global financial foundations to their cores. It's inevitable, but, getting the timing right is probably going to be next-to-impossible.

China has been buying oil from Saudi Arabia with yuan, which will be redeemable in gold. Saudi oil trade is $58 Billion (according to VBL). Singapore and Malaysia will receive gold-pledged (renminbi) RMB loan services, as will some African nations.

China is seeding the rest of world with gold by circulting 100 RBM gold bars, though it's unclear whether China will make any official declaration about a gold-backed Yuan for international trade settlement at the upcoming BRICS Summit in Brasil, next week (July 6-7, idleguy.com will update)

The question, now that it's clear a duopoly of reserve currencies is emergent - Gold-backed yuan and U.S. Treasury-backed crypto-coins - is which one do you prefer, or, can they both be used interchangably?

It's easy to envision a scenario in which some Middle East country like Saudi Arabia or UAE will sell oil to anybody they please and accept payment in whatever currency they and the buyers agree upon. There might be (probably will be) a premium for $US versus gold, but that also could depend on the price of gold at the time as well as current political conditions. It's about to get complicated for some, but, those most capable of being flexible and smart are likely to flourish, much as traders on the ancient Silk Road found out selling spices and linen across multiple jurisdictions, accepting multiple currencies in exchange.

Trying to make sense out of what's ahead, just consider trying to pay for a luncheon in Cincinnati with anything other than US dollars. It's simply not done. However, in places as far-flung as Zimbabwe, which now uses multiple foreign currencies, including the US dollar and the South African rand in addition to their own gold-backed currency and probably soon, China's yuan and the euro, to Panama, where the US dollar is used alongside the Panamanian balboa, which is pegged to the dollar at par.

Other examples include East Timor (Timor-Leste): The US dollar is the official currency, but the country also issues its own coins; Caribbean Netherlands (Bonaire, Saint Eustatius, and Saba), the US dollar is used alongside the Netherlands Antillean guilder; Cambodia: The Cambodian riel is the official currency, but the US dollar is widely accepted and often used for larger transactions, and; Lebanon: The Lebanese pound is the official currency, but the US dollar is also commonly used, especially in business and trade and especially since the country is essentially bankrupt.

Use of foreign currency isn't an issue in many cases thanks to online services. Having a PayPal account or using the PayPal debt card covers more than 200 countries and 25 currencies.

Visa, Mastercard and Ameican Express have been doing currency swaps for customers for decades, so, when making purchases, denominating that spend in many currencies is not difficult. The bigger question occurs when it comes to saving and/or accumulating wealth. Do you want your stationary money in US$, bitcoin, Tether, yuan, euro, yen, rubles, rupees, or baht? Or, maybe gold or silver is your preference.

That's where things may get a lttle tricky and sticky. For instance, if you begin to horde large amounts of Russian rubles, the IRS may come sniffing around. Or, the FBI, or FinCEN, the enforcement arm of the U.S. Treasury. After all, if you're an American and America is sanctioning Russia, why would you want rubles? Your government may want to know.

There are a plethora of reasons why countries have their own currencies, but, for individuals, it comes down to the age-old concept of saving, which is different from the Americanzied concept of "investing."

Saving money means you are accumulating money (or currency, more appropriately) for future use. Investing is just a more polite way to say "speculating." Investing seeks profit in the form of growth or income. Saving expects nothing more than a stable store of value.

And here's why your choice of currency, or even multiple choices, which may turn out to be the preferred route, matters. Let's go back in time to 1963, anywhere in America. Somehow, you, at the tender age of 8, have gotten your hands on $1000, and, you decide to not be dumb like most of your friends. You plan on saving that $1000. Here's the tricky part:

You either have 100 $10 bills, or 4000 silver quarters.

Now, the bills are obviously more convenient and easier to hide, and since you intend to not touch these until your retirement, they can be safely tucked away just about anywhere.

Those quarters, however, are heavy, bulky, and noisy. Hmmmm.

Back in the present, you are now 70 years old and suddenly remember that you socked away that $1000 many years ago. If you kept the money in $10 bills, it's still worth $1000 in US currency. Back in 1963 that $1000 would have bought you a new car, maybe even a small house. Today, in 2025, $1000 isn't even a decent down payment on a car. Forget about buying a house. $1000 would be a deposit at best, enough to get your real estate agent to present an offer. That's about it.

But, if you had 4000 silver quarters, which, in 1962, were 90% silver, you'd have the equivalent of $26,027.64 in $US with silver at the current price of $35.98 per troy ounce. Cha-ching! (that we could all be so prescient and precocious)

You will choose a currency for saving at some point. Choose wisely.

Further reading:

BRICS' Game-Changing Blockchain Payment System: The Future of Global Transactions

There will be updates in coming days and probably into August and beyond.

To close for now, because of our self-imposed July 1 deadline, here's Mike Maloney and Alan Hibbard with a deeper dive into stablecoins, gold and the U.S. dollar.

Thoughtful Money's Adam Taggart features Kyla Scanlon, a favorite of Millennials and GenZ who is widely followed across TikTok, Instagram, YouTube, X and Substack, about how the ongoing financial upheaval relates to young people.

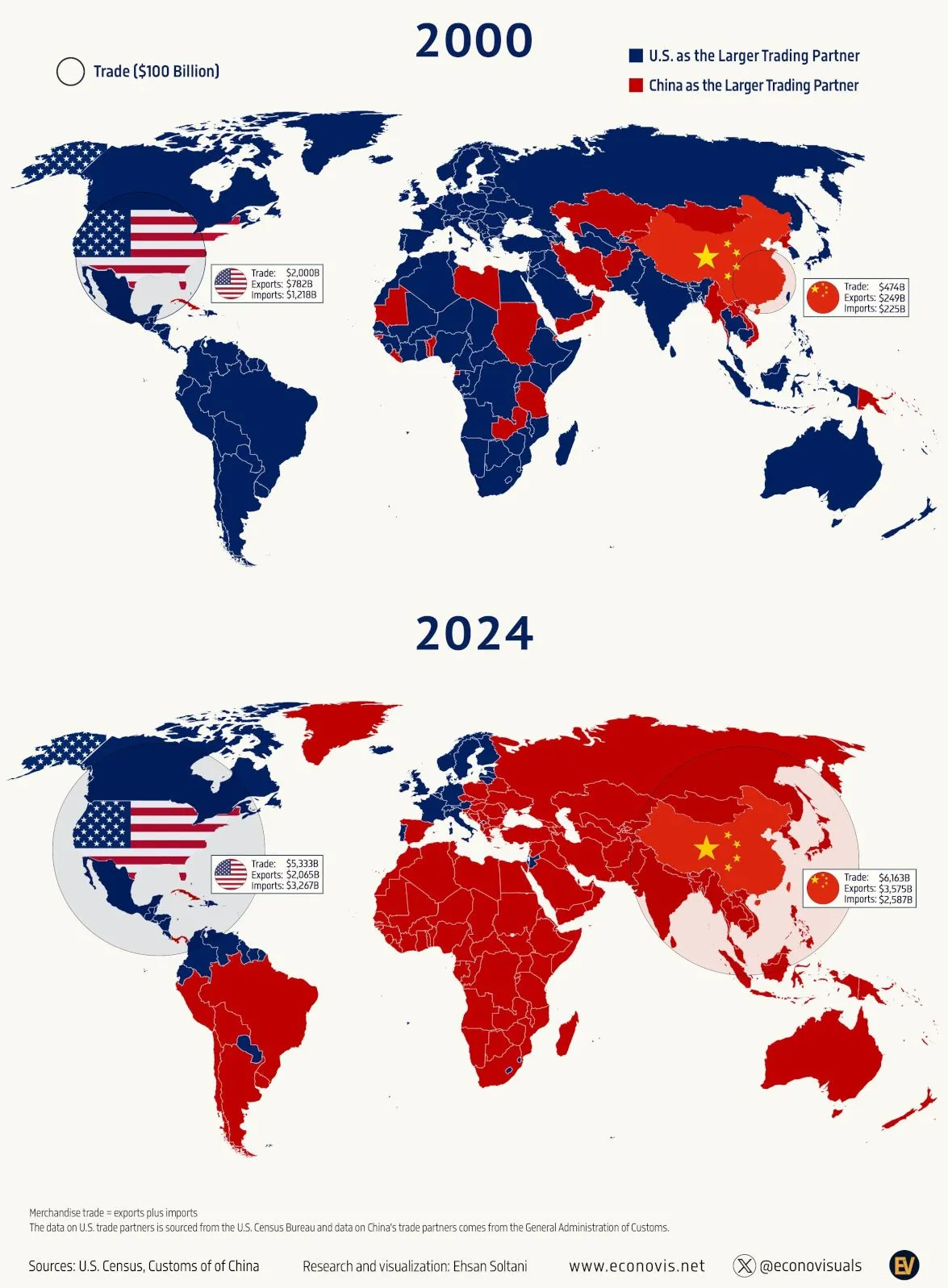

This graphic shows how money is shifting in international trade, toward China, away from the U.S.

3. We welcome the Republic of Indonesia as a BRICS member, as well as the Republic of Belarus, the Plurinational State of Bolivia, the Republic of Kazakhstan, the Republic of Cuba, the Federal Republic of Nigeria, Malaysia, the Kingdom of Thailand, the Socialist Republic of Vietnam, the Republic of Uganda, and the Republic of Uzbekistan as BRICS partner countries.

21. We condemn the military strikes against the Islamic Republic of Iran since 13 June 2025, which constitute a violation of international law and the Charter of the United Nations, and express grave concern over the subsequent escalation of the security situation in the Middle East. We further express serious concern over deliberate attacks on civilian infrastructure and peaceful nuclear facilities under full safeguards of the International Atomic Energy Agency (IAEA), in violation of international law and relevant resolutions of the IAEA.

The people have been turned into "hosts" (a food source - rent payers) for the 1% parasites (leeches/rent collectors) by the re-establishment of the "West Virginia Coal Mine Experience" (circa 1900). See Earned vs. Unearned income.

The people have been turned into "hosts" (a food source - rent payers) for the 1% parasites (leeches/rent collectors) by the re-establishment of the "West Virginia Coal Mine Experience" (circa 1900). See Earned vs. Unearned income.

News travels fast, so, on July 1, Circle applies for US Trust Bank Charter to manage USDC reserve.

News travels fast, so, on July 1, Circle applies for US Trust Bank Charter to manage USDC reserve.

According to VBL's analysis, China is building a gold corridor to facilitate trade to BRICS and Global South (Africa, South America, East and South Asia, Pacific Rim) with a Saudi Arabia vault, a Shanghai vault, another planned for Singapore and the probability of more vaults in Africa and South America as China builds out its Yuan-Gold infrastructure.

According to VBL's analysis, China is building a gold corridor to facilitate trade to BRICS and Global South (Africa, South America, East and South Asia, Pacific Rim) with a Saudi Arabia vault, a Shanghai vault, another planned for Singapore and the probability of more vaults in Africa and South America as China builds out its Yuan-Gold infrastructure.

The answer to the latter part of the proposition is pretty much a big, fat NO, in Western countries. In the Global South, there's probably a very good chance that countries, and eventually, businesses and individuals, will carry on trade in just about anything, be it digital, physical, gold-backed or pure fiat.

The answer to the latter part of the proposition is pretty much a big, fat NO, in Western countries. In the Global South, there's probably a very good chance that countries, and eventually, businesses and individuals, will carry on trade in just about anything, be it digital, physical, gold-backed or pure fiat.

Why This Matters

|

|||

| search engine by freefind |

Money Daily: WEEKEND WRAP (July 6): Post Independence Day, Peace, Prosperity, Tariffs, BRICS, Higher Stock Prices, Lower Oil and Gas Prices Are on the Agenda

Your ad could be in the next issue of idleguy.com for as little as $6 per month. Contact Fearless Rick using the form on page 12 for more information.

Use Coupon Code SUMMER20 for 20% off all orders at the HOT SUMMERTIME SALE of vintage magazines, going on now!