Does China Need the U.S. or Vice Versa?

Does China Need the U.S. or Vice Versa?

The current trade war between the United States and China is complex, with both countries employing tariffs as leverage to address deep-rooted economic and strategic concerns. Rather than producing clear winners and losers, the situation has set in motion significant structural changes that may benefit one side in some areas while disadvantaging it in others. Furthermore, international trade outside that of the two main proponents will be affected in varying degrees.

The conflict escalated in earnest around 2018 when the Trump administration imposed tariffs on a wide array of Chinese goods. The declared goals were to combat issues like intellectual property theft, forced technology transfers, and the massive trade imbalance between the two nations. China countered with its own tariffs, leading to a cycle of escalation. In April of this year, U.S. tariffs on Chinese imports reached startling levels (in some sectors over 140%), while China levied steep tariffs on American products as well. This tit-for-tat approach is reminiscent of past protectionist measures such as the Smoot-Hawley Tariff, though the modern context is complicated by intertwining global supply chains and the high stakes of technological and geopolitical rivalry.

Implications for the United States

For the U.S., tariffs have served a dual purpose. On the one hand, they are a tool intended to coerce China into changing practices seen as unfair. If successful, this could help American companies compete on a more balanced playing field by addressing issues like intellectual property protection and forced technology transfers. On the other hand, these tariffs will likely increase costs for U.S. manufacturers and consumers by disrupting established supply chains. Industries that rely on Chinese imports have are already expecting higher production costs, and while some domestic sectors might benefit from reduced competition, the current environment has fostered significant uncertainty and fears of inflationary pressures returning. The net benefit for the U.S. will ultimately depend on whether the pressure yields substantial reform in China without undermining American competitiveness.

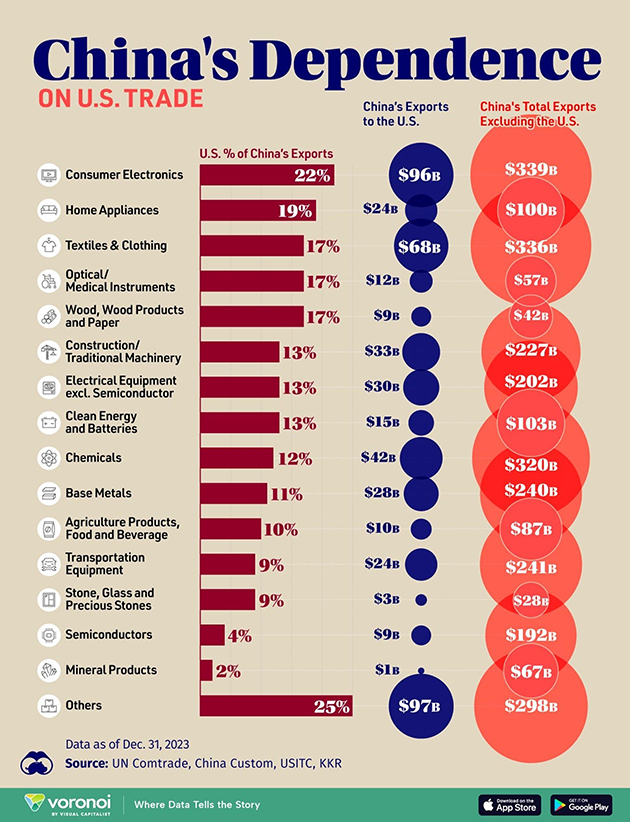

Implications for China

Facing mounting tariffs, China has begun to accelerate its strategy to pivot from an export-driven growth model to one that emphasizes domestic consumption and technological self-reliance, though their efforts so far have not yielded exclusively positive outcomes. This push has driven investments in upgrading technology and diversifying supply chains, potentially cutting the nation's economic dependence on exports to the United States. While the immediate impact of retaliatory tariffs has placed pressure on Chinese exporters, the long-term structural adjustments could bolster China's capacity to innovate and reduce vulnerabilities in critical sectors. In this light, even if painful in the short term, the trade war might ultimately serve as a catalyst for China to transform into a more balanced economy while reinforcing its global economic strength and technological leadership.

Who Benefits in the End?

In a nuanced battle like this, "benefit" should be understood in terms of strategic realignment rather than immediate financial gain. The United States stands to gain if its tariff strategy forces China to adopt more transparent and equitable trade practices, potentially leveling the playing field in key sectors such as technology. However, if these protective measures inflict too much collateral damage on U.S. industries by disrupting supply chains or triggering retaliatory measures that hurt domestic sectors, then the benefits could be offset by broader economic costs.

Conversely, China's response has been to use the trade war as an impetus to modernize its economy and assert greater technological autonomy. If it succeeds, China could emerge stronger by not only mitigating the direct effects of tariffs but also by reconfiguring its economic model in its favor. The ultimate outcomes hinge on each side's ability to adapt. If China can effectively drive innovation and build new markets, or if the U.S. can recalibrate its domestic industries to thrive without overreliance on a single foreign market, then each may claim partial victories.

Ultimately, the trade war is less about an outright victory for one side and more about triggering long-term shifts in the global economic architecture. Both nations face significant short-term pressures and long-term opportunities, and their success will depend on how adeptly they adjust their economic strategies and form new alliances. As global supply chains realign and regional partnerships evolve, the ripple effects of these policies will shape not only U.S.-China relations but also the broader international trading system.

Graphic Credit: Visual Capitalist | Original

More:

Trend Research

Foreign Affairs

Peterson Institute for International Economics (PIIE)

|

|||

| search engine by freefind |

Your ad could be in the next issue of idleguy.com for as little as $6 per month. Contact Fearless Rick using the form on page 12 for more information.