Show Me the Numbers!

Key Metrics for Working-Age Individuals

Median weekly earnings in the U.S.: $1,165

Percentage of adults with credit card debt: 41%

Percentage of households carrying a mortgage: 24%

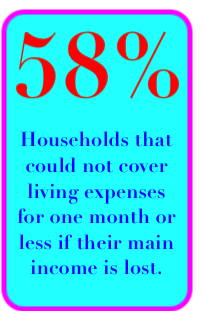

Households that could not cover living expenses for one month or less if their main income is lost: 58%

Employed workers saving in an employer-sponsored or outside retirement plan: 83%

Median age at which people begin saving for retirement: 26

Percentage who have tapped into retirement accounts via loans or early withdrawals: 37%

Current average retirement age in the U.S.: 64

Expected retirement age for today’s workers: 66

Full Social Security retirement age for those born in 1960 or later: 67

Percentage who plan to live to age 100 or beyond: 20%

Percentage expecting to retire at age 70 or not retire at all: 55%

Percentage planning to continue working at least part time in retirement: 56%

Percentage of retirees (3–14 years into retirement) who cite working as a favorite activity: 10%

Federal debt held by the public reached about 120.9% of GDP in the first quarter of 2025

Debt held by the public: $37.23 trillion

Nominal GDP: $30.33 trillion

Debt-to-GDP ratio: 122.75%

Total federal outlays in 2025: $7.0 trillion (23.3 percent of GDP)

Net interest payments on the federal debt (2025): Approximately $1.0 trillion, or 3.2 percent of GDP

Approximately 26.5 million U.S. adults, which is about 10.3 percent of the adult population, carry more than $20,000 in credit card debt or student loan debt (or both).

Credit card debt > $20,000: Estimated 10.5 million adults (Roughly 4.1 percent of all U.S. adults)

Student loan debt > $20,000: Estimated 18 million adults (Roughly 6.9 percent of all U.S. adults)

Overlap (both debts > $20,000): Estimated 2 million adults (Roughly 0.8 percent of all U.S. adults)

U.S. adult population (18+) approximately 258 million.

About 60 percent of adults carry any credit card balance; roughly 7 percent of cardholders owe over $20,000.

Roughly 45–50 million Americans hold federal student loans; data suggest around 40 percent of those borrowers owe more than $20,000.

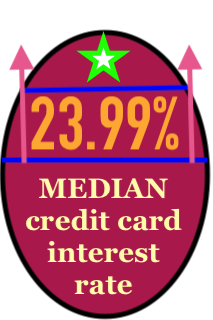

Average APR: 23.99% - Median advertised APR across over 300 credit-card offers as of August 2025

Highest APR: up to or exceeding 30% - Cards marketed to borrowers with poor or no credit often carry APRs at or above 30%

Auto Loan Interest Rates

Average APR

New car loans: 7.30%

Used car loans: 10.90% - Experian data for Q1 2025 (reported June 2025)

Highest APR (lowest credit tiers)

New vehicles: 15.81% APR (credit scores 300–500)

Used vehicles: 21.58% APR (credit scores 300–500) Based on Experian’s Q1 2025 data

Sources:

Investopedia |

Forbes |

Wall Street Journal

Prices double when cumulative inflation reaches 100 percent. Using the Rule of 70 (doubling time ≈ 70 / inflation rate):

Federal Debt: Total Public Debt as Percent of Gross Domestic Product

Households experiencing monthly income fluctuations: 31%

Households experiencing monthly income fluctuations: 31%

Key Metrics for Retirees

U.S. Debt-to-GDP Ratio

Projected full-year 2025 figures show:

Projected full-year 2025 figures show:

Estimated Adults with Over $20,000 in Credit Card or Student Loan Debt

Current Interest Rates on Credit Cards and Auto Loans

Credit Card Interest Rates

Credit Card Interest Rates

Inflation

INFLATION

DOUBLES

PRICES

OVER

TIME

Annual Inflation Rate

Doubling Time (years)

Calculation

2 percent

35.0

70 / 2

3 percent

23.3

70 / 3

4 percent

17.5

70 / 4

5 percent

14.0

70 / 5

Resources:

|

|||

| search engine by freefind |

Your ad could be in the next issue of idleguy.com for as little as $6 per month. Contact Fearless Rick using the form on page 12 for more information.

Use Coupon Code SUMMER20 for 20% off all orders at the HOT SUMMERTIME SALE of vintage magazines, going on now!